For those looking to purchase a 2-4 unit building in Chicago, one of the most important variables to accurately forecast is the appropriate value of the property - whether it be a stabilized purchase value, or the anticipated after repair value (ARV). The appraised value of 2-4 units is unique as appraisers do not follow the NOI approach utilized on 5+ units buildings. They instead focus almost exclusively on the comparable approach with a tip of the hat given to the Gross Rent Multiplier (GRM). For the sake of this blog we will only focus on the comparable approach portion as it carries the lionshare of the weight. If there is an appetite to learn more about GRM approach, feel free to reach out and we will write up a separate article.

The comparable approach is similar to the method used to evaluate single family properties, but with slight variations. Grasping the basic fundamentals of this approach will not only simplify your analysis of 2-4 unit properties, but also help you better understand their actual value. This is a sizable benefit in a city where 26% of the housing stock is made up of 2-4 units1.

Comparable Approach

The majority of your appraised value will derive from the comparable approach which is simply comparing your subject property to four, five, or six recently sold 2-4 unit properties. The appraiser adds or subtracts value from these sales prices based on how certain features differ from your subject property.

Features evaluated on every appraisal will be items like room, bed, and bath count, condition of the property, square footage, and basement finish. In addition, the appraiser will most likely include attributes like parking, porch/deck, amenities, view, and heating/cooling systems. To better explain, let’s look at an example pulled from a recent 3-unit appraisal.

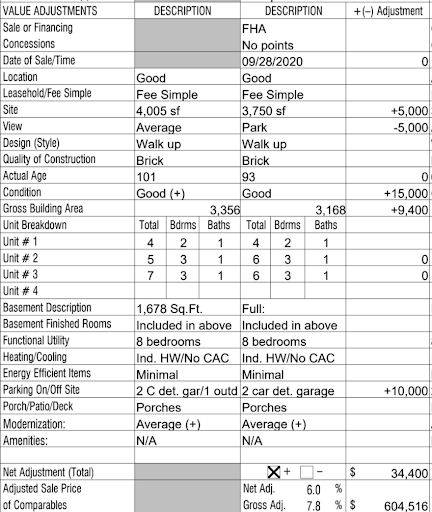

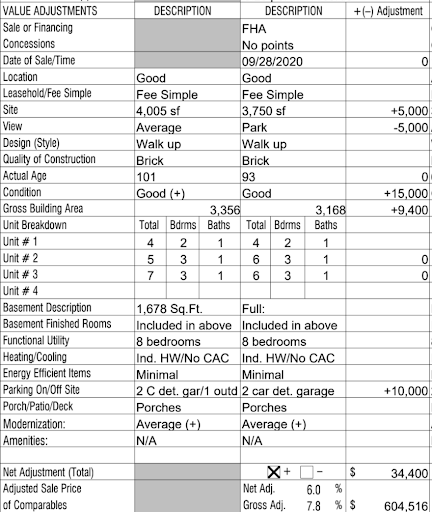

In the above screenshot, the first column consists of the different attributes the appraiser utilized for the comparable approach. The second column is the subject property (address would be the row above this but removed for privacy), the third column is a sold comp (comp #1), and the final column is the +/- adjustment the appraiser is debiting or crediting to the sold comp for any variance from the subject property.

For example, in row 6 (site), the subject property is 4,005 sq ft, but comp 1 is only 3,750 sq ft. The appraiser therefore adds $5,000 (row 3 column 4) to comp 1 to adjust for comp 1 being a slightly smaller property.

Note that it may seem counterintuitive to add the dollar amount to the inferior property. However, look at it this way - comp 1 is smaller than the subject property. Therefore, an adjustment should be made to comp 1’s sales price to make it a more apples to apples comparison. If you do not make this adjustment, your subject property will be punished as it’s being compared to a sales price of a smaller comparable. The appraiser will make these additions and subtractions for each row, and tally them up to arrive at an adjusted sold price that best represents a fair comparison to the subject property. Summary on a bumper sticker - “you want the appraiser to be adding to the comparable properties.”

In row 7 the appraiser states that comp 1 oversees a park while the subject property is just on an average side street. He debits 5,000 from the comp 1 sale price feeling that is a fair adjustment for the superior view.

It’s worth mentioning that another comparable property was on Montrose, an every 4 block busy street, and the appraiser added 25,000 to that comparable’s sold price to adjust for the location. This is just an FYI to help you make the appropriate adjustment when evaluating 2-4 unit buildings on busy streets.

It is somewhat arbitrary (more on this later), but the appraiser considers the subject property to be in “Good+” condition, while comp 1 is only in “Good” condition. He allocates an additional 15,000 to the sale of the sold comp.

The other main drivers of adjustments are the subject property has a larger gross area, and also has 2-car garage and a parking pad. Comp 1 only has a 2-car garage, no parking pad. These allocations are +9,400 and +10,000 respectively.

When there is no adjustment made in Column 4, the appraiser simply feels the properties are equal for that speicfic line item (boh have porches, boh have the exact same unit/bed/bath breakdown...etc). So summing up Column 4 the appraiser arrives at a net adjusted total of $34,400 to be added to the sale price of comp 1.

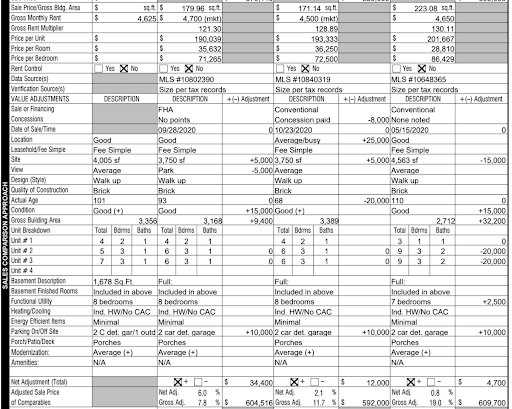

The original sales price of comp 1 was $570,116. Given the +/- adjustments in Column 4, the most accurate price for comp 1 when comparing it to our subject property should be 604,516 (the original $570,116 sales price plus the $34,400 in net adjustments). Hopefully it's now easier to visualize why it is in your best interest to have positive adjustments to the comparables. The appraiser will do this exercise for each comparable and below is a summary evaluating the subject property against comp 1, comp 2, and comp 3 (comps 4 and 5 are on a separate page in the appraisal).

Great info Tom, but why should I care about this comparison approach? Well, two main reasons. Firstly, the better you understand how appraisals work, the better you can predict your appraised value. The more honed in you are to this value, the more confident you can be in your offer as you have minimized both an unknown and the variance of your expected return. Secondly, and more importantly, this fundamental understanding ties into a key takeaway that you need to prepare for your appraisals and anchor the appraiser on a desired yet realistic number backed by data.

Prepare for your appraisal

In our above example, the appraiser came up with a net adjustment of $34,400 for comp 1 when evaluating it against the subject property. If you had ten different appraisers perform the same matching exercises between comp 1 and the subject property, you would arrive at ten different answers for the net adjustment. All would likely be close to $34,400, but some might be in the high $20,000s, some might crack the $40,000 threshold. Now take this variance for each line item across the 4-6 comparable properties in the report and it’s easy to see that a range in value exists.

The point is that appraisals are difficult! They are scientific but there is an art to them. In the above example, why was the credit for “Good+” condition compared to “Good” $15,000? Why wasn’t it $25,000? Or $10,000? The same can be said for almost every line item; and all these line items add up. At the end of the day, most appraisers would probably land at this property being worth somewhere between $575-$615k. This is a very respectable range - less than 5% each way from the median - but that low-end number to high-end number is a huge swing for an investor and their returns.

Knowing that this variance exists, you are doing yourself a disservice by not pulling realistic comparables before your appraisal and letting the appraiser know your expectation of value based on the market data at hand. The appraiser may use these comps, or he may throw them out. Either way, you should set the expectation and put the onus on him to prove that your property is not worth the amount your data is showing. If this is done with realistic numbers and in a professional manner, you are actually making the job easier for the appraiser.

How to prepare for your appraisal is a whole separate blog, and we covered this topic with our friends at Renovo in a past Tuesday Tip Episode if you are interested in hearing more: https://www.straightupchicagoinvestor.com/podcast/episode-87-straight-up-tues-tip-11

The better you understand appraisals, the better you understand value. The better you understand value, the more confident you can be in your offer, and you will also start to see value where others might miss it. Inversely, you will avoid silly mistakes that lead to overvaluing a property - comparing your 2/1 units to 2/2 units, not accounting for a comp being larger as it’s on a 40ft lot, comparing frame to brick...etc. Your subject property need not have all the attributes of your comparables, you just need to quantify how those differences affect your anticipated value. Doing so will prevent you from overpaying and to also help you find under realized value.

Tom Shallcross is the co-host of the Straight Up Chicago Investor Podcast and is an active investor, flipper, and licensed agent (Second City Real Estate MLS 46067) on the Northside of Chicago. He can be reached at nowservingproperties@gmail.com